Go to the mytax homepage and click “register a new business: You must send your tax return by the deadline or you’ll get a penalty. Prepare to have the following information ready to complete the dc online tax registration form: There is no charge for registering. Department of tax and revenue.

Registration is required and ensures that payments and returns properly post to a taxpayer’s account. This guide is also available in welsh. On the mytax.dc.gov homepage, locate the business section. Web download or request forms to help you send your tax return either online or by post.

If you own the property under your personal name, you would select “sole proprietor”. The form is relatively short and can be easily filled out by most taxpayers. Web download or request forms to help you send your tax return either online or by post.

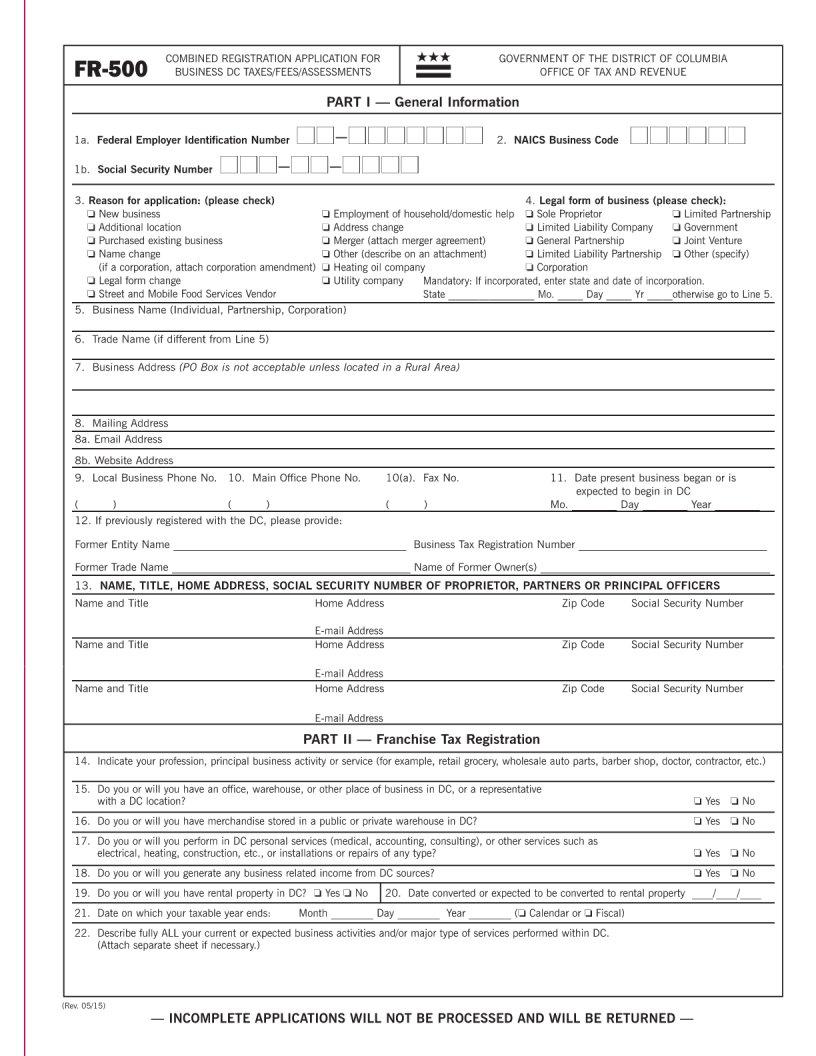

The purpose of this form is to gather information on the business, such as ownership, location, and type of business, which is needed to determine the employing unit’s liability to pay taxes in the district of columbia. In order to apply for an itin, you must complete the entire form and submit it with your supporting documentation. If you own the property under your personal name, you would select “sole proprietor”. The form is relatively short and can be easily filled out by most taxpayers. Web learn how to register a new business with the district of columbia online tax portal, mytax.dc.gov.

In order to apply for an itin, you must complete the entire form and submit it with your supporting documentation. The purpose of this form is to gather information on the business, such as ownership, location, and type of business, which is needed to determine the employing unit’s liability to pay taxes in the district of columbia. The form is relatively short and can be easily filled out by most taxpayers.

Web Learn How To Register A New Business With The District Of Columbia Online Tax Portal, Mytax.dc.gov.

The purpose of this form is to gather information on the business, such as ownership, location, and type of business, which is needed to determine the employing unit’s liability to pay taxes in the district of columbia. Initial registration and when making changes to your account. Registration is required and ensures that payments and returns properly post to a taxpayer’s account. This guide is also available in welsh.

On The Mytax.dc.gov Homepage, Locate The Business Section.

On or before april 18, 2022 for calendar year filers; Prepare to have the following information ready to complete the dc online tax registration form: Go to the mytax homepage and click “register a new business: In order to apply for an itin, you must complete the entire form and submit it with your supporting documentation.

If You Own The Property Under Your Personal Name, You Would Select “Sole Proprietor”.

For further assistance, please contact the customer service center. On or before the 15th day of the fourth month following the close of the taxable year for fiscal filers. There is no charge for registering. Web download or request forms to help you send your tax return either online or by post.

The Form Is Relatively Short And Can Be Easily Filled Out By Most Taxpayers.

Fr 500 tax registration package pdf. You must send your tax return by the deadline or you’ll get a penalty. Go here to start the form: Fr 500 combined business tax registration application.

On or before the 15th day of the fourth month following the close of the taxable year for fiscal filers. Registration is required and ensures that payments and returns properly post to a taxpayer’s account. Prepare to have the following information ready to complete the dc online tax registration form: Department of tax and revenue. On or before april 18, 2022 for calendar year filers;