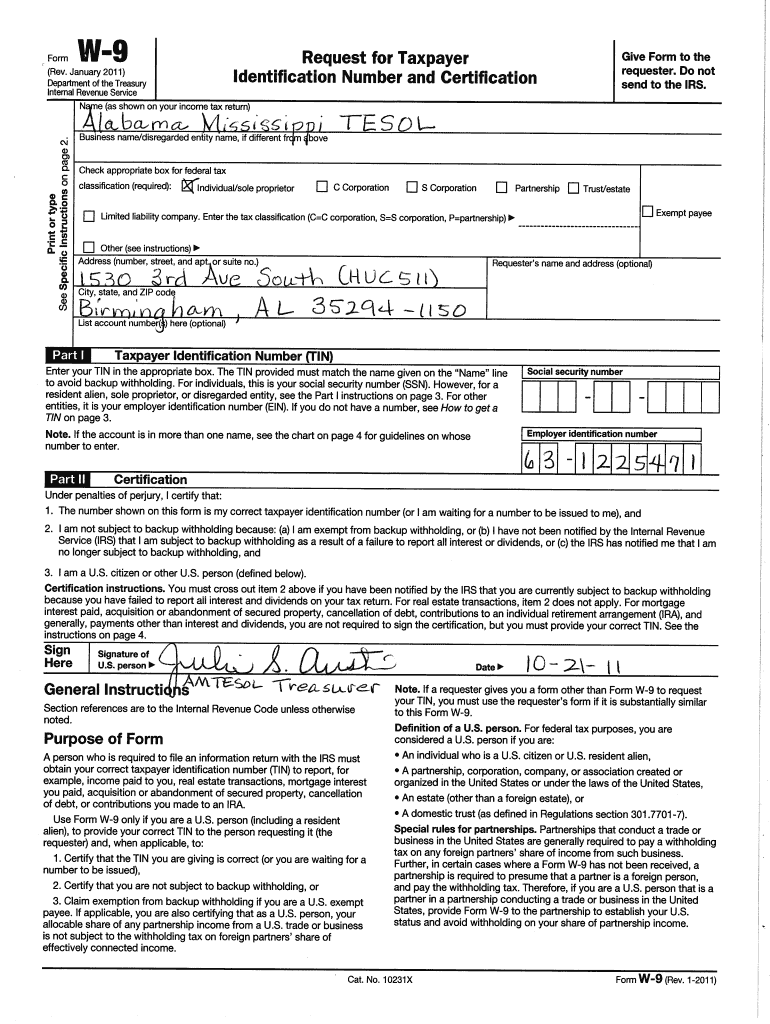

Who needs to fill them out? Web 第一部分:納稅人識別號碼 (tin) a欄 個人/獨資經營業主:填寫您的社會保障號碼(ssn)。. For individuals, the tin is generally a social security number (ssn). Independent contractors who were paid at least $600. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or.

Do not send to the irs. March 2024) request for taxpayer identification number and certification department of the treasury internal revenue service go to www.irs.gov/formw9 for instructions and the latest information. What do you do with it? Claim exemption from backup withholding if you are a u.s.

Claim exemption from backup withholding if you are a u.s. Who needs to fill them out? Do not send to the irs.

2020 W9 Form Fill Out Online W9 Form 2020 Printable throughout Irs

W9 Form 2023 Example Printable Forms Free Online

Free Fillable W9 form W9 Invoice Template attending W11 Invoice

What do you do with it? For individuals, the tin is. Claim exemption from backup withholding if you are a u.s. This article describes the new version. It lets you send your tax identification number (tin)—which is your employer identification number (ein) or your social security number (ssn)—to another person, bank, or other financial institution.

This article describes the new version. Web 第一部分:納稅人識別號碼 (tin) a欄 個人/獨資經營業主:填寫您的社會保障號碼(ssn)。. However, in some cases, individuals who become u.s.

Independent Contractors Who Were Paid At Least $600.

For joint accounts, each account holder must complete a separate form. Do not send to the irs. 向您支付的收入。 房地產交易。 您支付的房屋貸款利息。 取得或放棄受擔保的財產。 債務消除。 給 ira 的供款 Claim exemption from backup withholding if you are a u.s.

For Individuals, The Tin Is Generally A Social Security Number (Ssn).

Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. It lets you send your tax identification number (tin)—which is your employer identification number (ein) or your social security number (ssn)—to another person, bank, or other financial institution. Tax withholding」,是美國國稅局 (internal revenue service,irs)五種制式表格之一。. However, in some cases, individuals who become u.s.

This Article Describes The New Version.

Who needs to fill them out? Web 第一部分:納稅人識別號碼 (tin) a欄 個人/獨資經營業主:填寫您的社會保障號碼(ssn)。. For individuals, the tin is. Web in this article.

March 2024) Request For Taxpayer Identification Number And Certification Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Formw9 For Instructions And The Latest Information.

Give form to the requester. What do you do with it?

Web in this article. Do not send to the irs. For individuals, the tin is. March 2024) request for taxpayer identification number and certification department of the treasury internal revenue service go to www.irs.gov/formw9 for instructions and the latest information. For joint accounts, each account holder must complete a separate form.