Use our 501c3 lookup table to find out whether or not an organization has 501c3 status. Web tax exempt organizations forms. How do i become federally exempt? Web for the tax year ended december 31, 2024, nonprofit def (“def”) carries on a single unrelated business, and def does business solely within tennessee. Web the initial registration must be filed online.

Nonprofit organizations engaged in making sales of. Filed for tax exemption (please include a copy of the irs forms. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural certificates. Application for exemption from sales tax for interstate.

Apply for exemption from state taxes. Web the initial registration must be filed online. A charity seeking an exemption because it does not actually raise or receive gross contributions from the public in excess of $50,000 during a fiscal.

Nonprofit organizations engaged in making sales of. All charitable organizations must register with this office unless they meet the criteria for exemption or file as a $50,000 and under exempt organization. Application for pollution control sales and use tax exemption. Use our 501c3 lookup table to find out whether or not an organization has 501c3 status. Web tax exempt organizations forms.

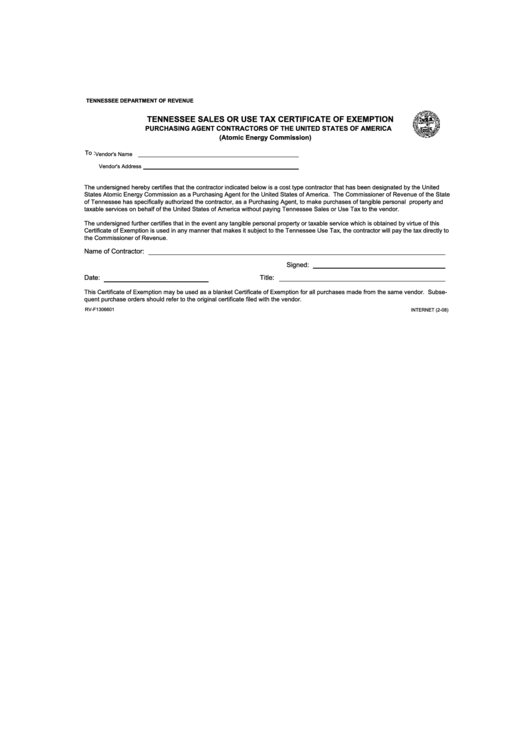

Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior. Tax exemption status (please check one): Web tax exempt organizations forms.

Every Fourth Year, The Tennessee Department Of Revenue Reissues Nonprofit And Agricultural Certificates.

A charity seeking an exemption because it does not actually raise or receive gross contributions from the public in excess of $50,000 during a fiscal. Yes no if yes, attach a copy of the amendment(s). Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior. Application for exemption from sales tax for interstate.

Certification Of Responsible Individuals For Certain Tax Exempt Organizations (Ss.

Tre hargett was elected by the tennessee general assembly to serve as. To get the 501 (c) (3) status, a corporation must file for a recognition of. Nonprofit organizations operating in tennessee may qualify for certain tax exemptions. Web the initial registration must be filed online.

All Charitable Organizations Must Register With This Office Unless They Meet The Criteria For Exemption Or File As A $50,000 And Under Exempt Organization.

As a nonprofit, your organization will be exempt from paying corporate income tax, state franchise tax,. State filing requirements for political organizations. Web tax exempt organizations forms. Web tennessee nonprofits state tax overview.

The Form Must Be Signed By Two Authorized Officers, One Of Whom Shall Be The Chief Fiscal Officer.

How do i become federally exempt? 501 (c) (3) lookup for tennessee. Have you amended the organization documents submitted with your last registration? Use our 501c3 lookup table to find out whether or not an organization has 501c3 status.

All charitable organizations must register with this office unless they meet the criteria for exemption or file as a $50,000 and under exempt organization. Nonprofit organizations operating in tennessee may qualify for certain tax exemptions. 501 (c) (3) lookup for tennessee. To get the 501 (c) (3) status, a corporation must file for a recognition of. Web the initial registration must be filed online.