Doc ( 39 kb) [your address] [bank address] dear sir/madam, Use this template letter to make a claim. You typically need to file a dispute within 60 days of the transaction. Government agency that makes sure banks, lenders, and other financial companies treat you fairly. If it hasn't, you can use this template letter.

A sample letter outlines what to include. This includes your account number, the disputed amount, the date of the charge, and any evidence supporting your claim (receipts, emails, etc.). Under section 75 you can claim against your credit card provider when goods you've bought with a credit card develop a fault. For example, the items weren’t delivered, i was overcharged, i returned the items, i did not buy the items, etc.

Web if you suspect you are the victim of credit card fraud, you can use a letter to dispute a fraudulent credit card transaction to help fix things. Charges for which you ask for an explanation or written proof of purchase, along with a claimed error or request for clarification. For example, the items weren’t delivered, i was overcharged, i returned the items, i did not buy the items, etc.

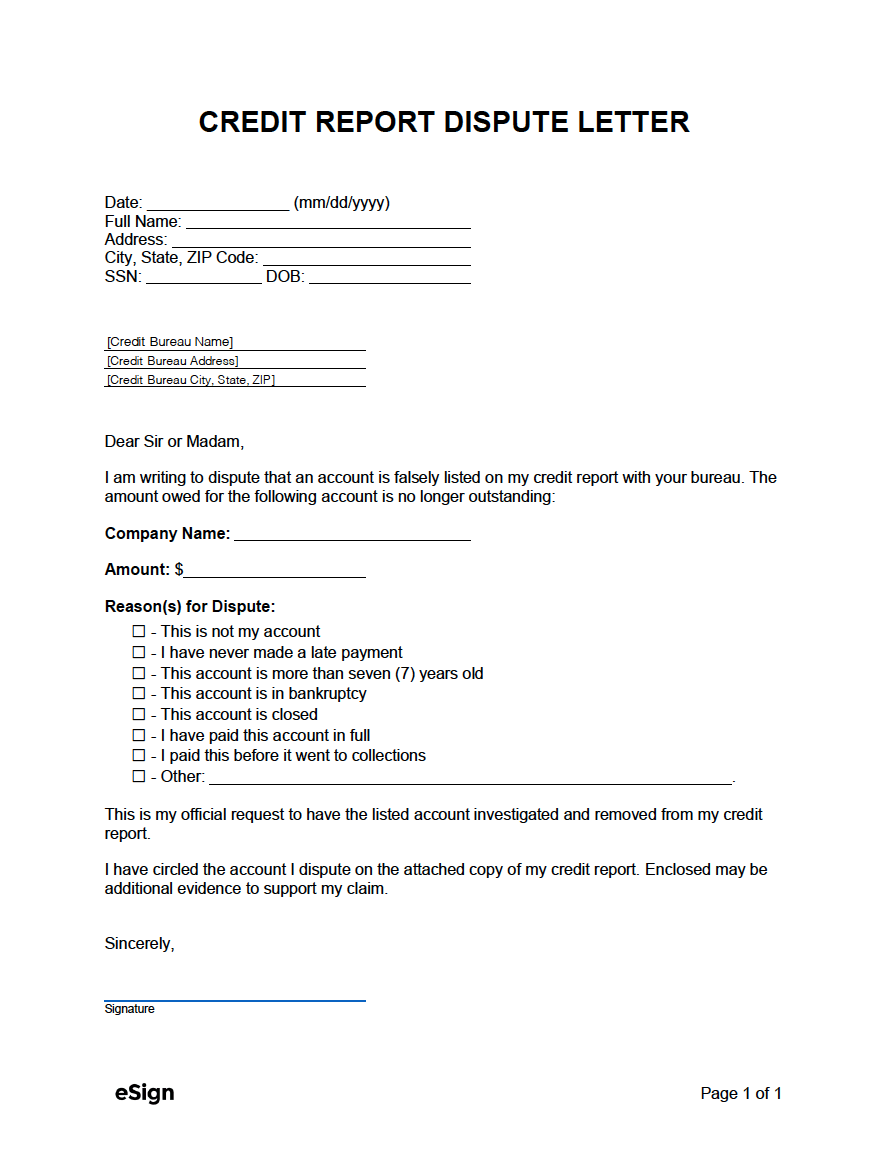

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

We're the consumer financial protection bureau (cfpb), a u.s. Dispute an item on a credit report. Experian, transunion and equifax now offer all u.s. Credit, banking, and debt relief / sample billing dispute letter. Failure to post payments or other credits, such as returns.

Your card provider may have a set process for submitting a claim for a refund of a disputed transaction. Charges for which you ask for an explanation or written proof of purchase, along with a claimed error or request for clarification. Consumers free weekly credit reports through annualcreditreport.com.

Government Agency That Makes Sure Banks, Lenders, And Other Financial Companies Treat You Fairly.

Failure to send bills to your current address. Consumers free weekly credit reports through annualcreditreport.com. Web here are six do’s and don’ts to help you win disputes and minimize hassles. Experian, transunion and equifax now offer all u.s.

If You Spot An Error On Yours, Writing A Credit Dispute Letter May Help Resolve The Issue.

Web by gayle sato. The ftc (which enforces the fair credit billing act) has a sample letter you can use. | legally reviewed by melissa bender, esq. What can i dispute on my credit report?

Dispute An Item On A Credit Report.

This includes your account number, the disputed amount, the date of the charge, and any evidence supporting your claim (receipts, emails, etc.). You typically need to file a dispute within 60 days of the transaction. Your statement will list the merchant’s name and also, typically, the. Web this means you'll need to send in a formal dispute letter by mail (yes, snail mail) within 60 days of the disputable charge.

Web While You May Be Able To Dispute These Charges Over The Phone, Some Companies May Also Require You To Send A Written, More Formal Letter To Explain The Issue And Why You Are Not Responsible For The Credit Card Debt.

A sample letter outlines what to include. This letter should clearly identify the disputed transaction, explain why it is being disputed, and request an investigation and correction of the error. We’ll show you some steps you can take. Web want a shortcut?

Consumers free weekly credit reports through annualcreditreport.com. Web if you suspect you are the victim of credit card fraud, you can use a letter to dispute a fraudulent credit card transaction to help fix things. So keep close tabs on your statements and check carefully for suspicious transactions. Filing a letter to dispute a fraudulent credit card. Box address] [city, state zip code] dear [recipient's name]:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-14-790x1022.jpg)