Rent receipts provide a formal record of the rent tenants have paid (or not paid) for a rental period, to help landlords and tenants avoid any future disputes. Generate rent receipt by filling in the valid documentary details. Get a stamp on the receipt & sign of the landlord. Why do we need rent receipts in hra? In case the owner of a property has let.

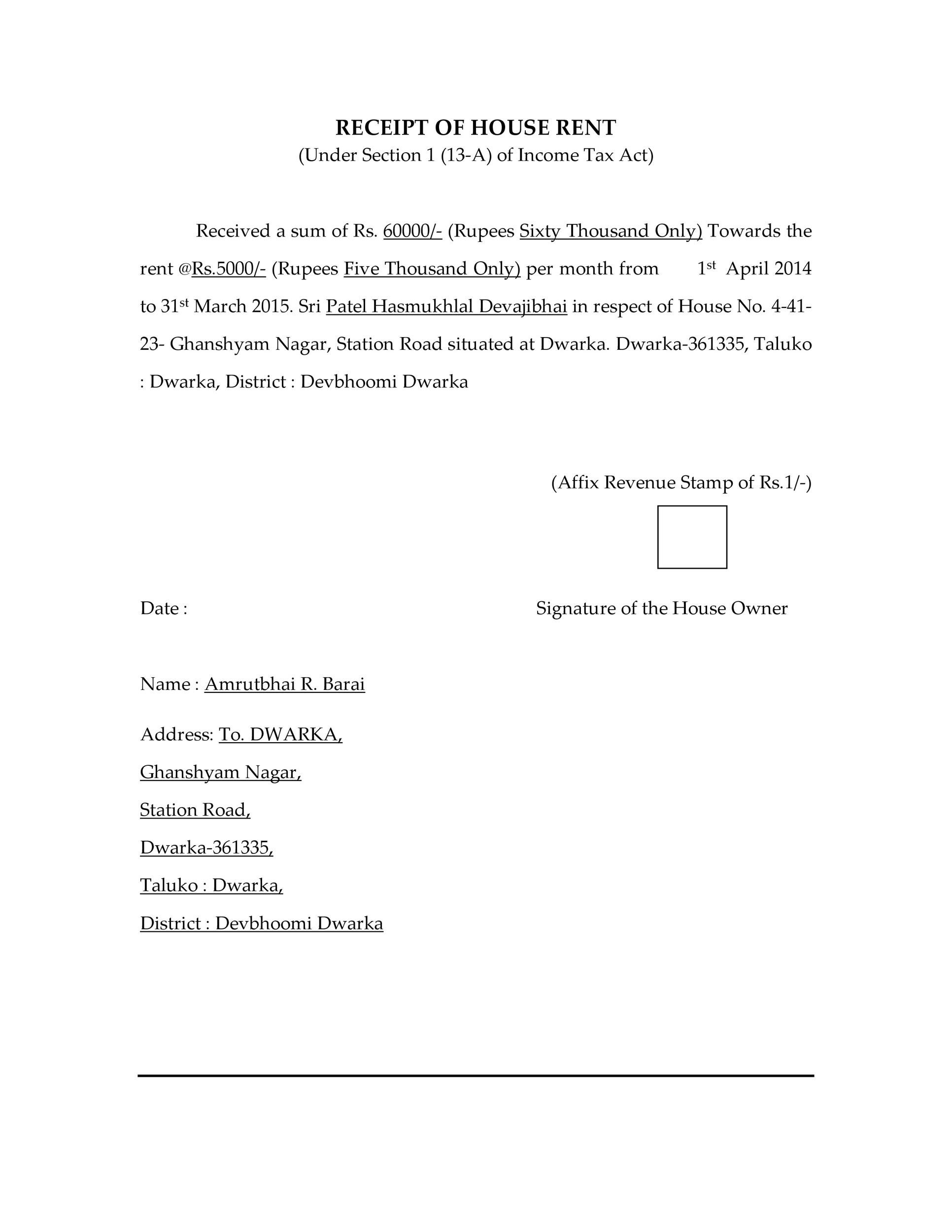

Web yes, revenue stamps are mandatory for cash rent payments exceeding rs.5,000 as per the indian stamp act, 1899. If you are wondering ‘is a revenue stamp required for a rent receipt,’ then the answer is yes. For landlords, rent receipts can be helpful for many reasons: Web a rent receipt is a document given to tenants (also known as a 'contract holder' in wales) by their landlord (or their landlord’s agent) each time they make a rent payment.

It is important to share rent receipts with the employer to claim hra exemption for monthly rent paid above ₹3,000 In the context of rent receipts, it serves as a legal indication that the transaction has been properly accounted. Web the rent receipt should be affixed with revenue stamp if the cash payment exceeds rs 5,000.

It is issued by the landlord and can be used for legal or taxation purposes. Is giving pan card photocopy necessary? Know the details of a rental agreement from the experts at nobroker rental agreement service. For landlords, rent receipts can be helpful for many reasons: Is giving landlord’s pan necessary?

If the monthly rent paid in cash exceeds rs 5,000, it is mandatory to affix a revenue stamp on the rent receipt and get it duly signed by the landlord. Interestingly, according to the indian stamp act of 1899, rent receipts can be issued without a revenue stamp, provided the monthly rental income or expense is below rs 5,000. The price of a revenue stamp is one rupee per stamp.

Web Following Are The Steps.

Affixation of revenue stamp on rent receipt. Web rent receipt with revenue stamp and its fomat. Get a stamp on the receipt & sign of the landlord. Web you will have to affix a revenue stamp on the rent receipt if the cash payment is more than rs 5,000 per receipt.

In Case The Owner Of A Property Has Let.

Rent receipt for every month is not compulsory, employer may ask for rent receipt of atleast four months. Is giving landlord’s pan necessary? Are monthly rent receipts needed? Web the indian stamp act of 1899 states that if your monthly rental income or expenses are less than rs 5,000, rent receipts can be issued without a revenue stamp.

What If I Fail To Submit Rent Receipts To My Employer?

Create rent receipt in few steps. If rent is paid through cheque or online transfer then revenue stamp is not required. Significance of revenue stamps in financial transactions. Web section 194i of the income tax act says the tenant must deduct 10% tds on rent generated from any land or building if the aggregate of the rent paid or likely to be paid during a financial year exceeds rs 2.40 lakh.

In The Context Of Rent Receipts, It Serves As A Legal Indication That The Transaction Has Been Properly Accounted.

Components of a valid rent receipt. A rent receipt includes important information such as the rent amount, date of payment received, and medium of transaction. Revenue stamps are a legal requirement in many jurisdictions and serve as proof of payment. Web are revenue stamps required for rent receipts in india?

Web you will have to affix a revenue stamp on the rent receipt if the cash payment is more than rs 5,000 per receipt. Also, you need not affix the revenue stamp. They help the landlord keep a record of all of the rent payments a tenant has paid in addition to when they made their payments and how much was paid. Then, get the rent receipt stamped & signed by landlord. The price of a revenue stamp is one rupee per stamp.