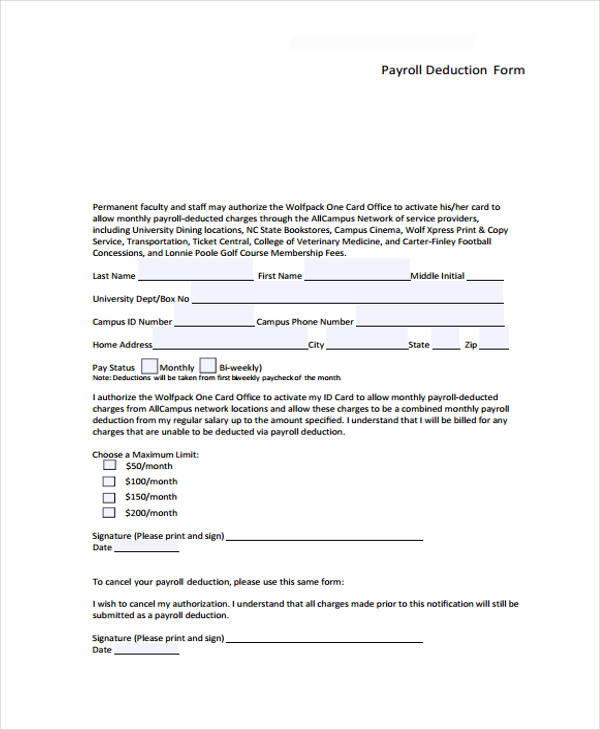

Web payroll authorization forms are one of the documents that employers, specifically the company’s human resource and finance department staff members, use for gathering the details of employees who would like to change or update their payroll information. $ per paycheck for the next paycheck(s) ☐ uniform rental and cleaning: Web type of deductions total requested amount deduction amount per pay period. I understand and agree that i am responsible for satisfying the above amounts. Available in a4 & us letter sizes.

The authorization must be clear and specific to the amount that is being deducted and its purpose. Web type of deductions total requested amount deduction amount per pay period. Web a payroll deduction form is a crucial document used by employers to authorize regular deductions from an employee’s paycheck. Tandem payroll ltd, 5 lancing.

Web form 2159 (may 2020) payroll deduction agreement (see instructions on the back of this page.) department of the treasury — internal revenue service catalog number 21475h www.irs.gov. Web for your group rrsp. Employees can use authorize deduction from their payroll with this form.

FREE 6+ Payroll Authorization Forms in PDF

Web payroll deduction form template. Instantly download payroll deduction authorization form template, sample & example in microsoft word (doc), google docs, apple pages format. Frequently asked questions (faqs) show. Available in a4 & us letter sizes. Always keep copies of letters on the employee’s file.

I understand and agree that i am responsible for satisfying the above amounts. Get authorization from an employee to make payroll deductions by having them sign this free downloadable form. Employee name * department * marketing.

Employees Can Use Authorize Deduction From Their Payroll With This Form.

Get authorization from an employee to make payroll deductions by having them sign this free downloadable form. I authorize [company name] to withhold from my wages the total amount of $ [amount] which shall be withheld at a rate of $ [amount. Always keep copies of letters on the employee’s file. (taxpayer name and address) contact person’s name.

Web Payroll Deduction Authorization Form Template.

Web authorizations for payroll deductions must be given by the employee to the employer in writing. Instantly download payroll deduction authorization form template, sample & example in microsoft word (doc), google docs, apple pages format. I hereby authorize my employer to make the above deductions from my pay in accordance with the above terms. Web ☐ frequently recurring deductions:

Most Employers Ask Employees To Provide A Voided Check When Completing The Form, As It Provides The Aba Routing Number That Identifies The Employee’s Bank And Account Number.

Employee name * department * marketing. Employees then provide signatures to authorize. Web form 2159 (may 2020) payroll deduction agreement (see instructions on the back of this page.) department of the treasury — internal revenue service catalog number 21475h www.irs.gov. Web employee payroll deduction authorization.

Payroll Departments May Also Receive Court Orders Directing Them To Withhold A Set.

Deduction type * start date of deduction * deduction amount * frequency of deduction * additional instructions * deduction authorization. The authorization must be clear and specific to the amount that is being deducted and its purpose. I hereby authorize the above deductions. Food, tools, supplies, phone, etc.) ☐ supplies or equipment purchase:

Web authorizations for payroll deductions must be given by the employee to the employer in writing. Web reason for deduction schedule of deductions amountdate employee signature date authorisation by employer yes no authorised signatory date please forward to tandem payroll ltd fax: Web benefit elections might come from authorization forms filled out by an employee, or selections made through an online portal. Web payroll wage withholding authorization i, _____, hereby authorize (company name) to withhold from my wages the total amount of $_____ which shall be withheld at a rate of $_____ per pay period for _____ [specify number] of pay periods for the purpose of [explain reason for withholding]. Web payroll authorization forms are one of the documents that employers, specifically the company’s human resource and finance department staff members, use for gathering the details of employees who would like to change or update their payroll information.