This typically includes salary, bonuses, wages, commissions, and so on that have been earned by the employees over their tenure in the company. Web here is a list of some examples of primary accounts that should be in your chart of accounts: Web the chart of accounts indicates the list of asset, liability, equity, income, and expense accounts that are used to assign regular business transactions. The calculation of payroll is highly influenced by the legal system of the home. Just a note that discussions here in xero is a place to start and join in conversations to help your peers with any questions they may have on using xero, or day to day business practices.

Web if you haven’t already, set up your payroll accounts in your chart of accounts (coa). Here’s what an average payroll chart of accounts list contains: Web here are five steps to follow to do payroll accounting manually: How does a chart of accounts work?

I am an independent xero, xero payroll and workflowmax specialist. Just a note that discussions here in xero is a place to start and join in conversations to help your peers with any questions they may have on using xero, or day to day business practices. Once on the import accounts page, you will see a list of all the accounts in your quickbooks online chart of accounts.

Small Business Payroll Software Simply Accounting Tutorial

Web structure your chart of accounts to gain insight into your payroll costs. Use the register to track employee information such as salary, pay schedule, vacation hours, exemption status,. Suggest you start with an account structure/framework and then fill in down to detail level needed. Select import accounts on the upper right corner. Web what is payroll chart of accounts in quickbooks?

The name of the account in the general ledger. If you are in nz, i'm currently offering a complimentary zoom session to answer your questions. Set up the chart of accounts.

Just A Note That Discussions Here In Xero Is A Place To Start And Join In Conversations To Help Your Peers With Any Questions They May Have On Using Xero, Or Day To Day Business Practices.

Payroll includes the gross pay due to the employee and employer taxes. Web if you haven’t already, set up your payroll accounts in your chart of accounts (coa). Payroll accounting is the recording of the compensation of a company’s employees. A chart of accounts can be thought of as a filing system for your financial accounts.

Web A Chart Of Accounts Provides A Complete Listing Of Every Type Of Account, Including Account Codes And Numbers For Assets, Liabilities And So On.

Web check out the latest product improvements we made for mapping payroll items to your chart of accounts in quickbooks online payroll.learn how to change your a. Suggest you start with an account structure/framework and then fill in down to detail level needed. This typically includes salary, bonuses, wages, commissions, and so on that have been earned by the employees over their tenure in the company. Generally, the chart of accounts has four different categories that are as follows:

Web Set Up And Configure Payroll Chart Of Accounts.

Use our template to see numbering & segmentation examples. It can also refer to a listing of employees giving details of their pay. If you are in nz, i'm currently offering a complimentary zoom session to answer your questions. This download offers two templates in one:

The Payroll Chart Of Accounts Is A List Of Names And Account Numbers Which Are Connected With The Company.

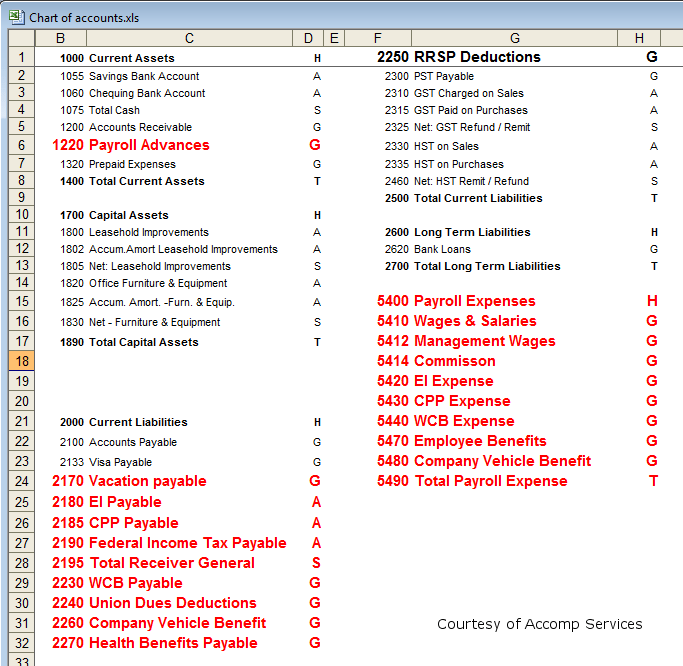

Firstly you’ll want to go to the chart of accounts page for payroll. The calculation of payroll is highly influenced by the legal system of the home. Payroll accounts include a mixture of expenses and liabilities. Web the sample chart of accounts is divided into the following columns:

Web what is payroll chart of accounts in quickbooks? Payroll is the aggregate expenditure on wages and salaries incurred by a business in an accounting period. The more info you provide in your initial post the. Expenses that fall under payroll accounting. Each account is given an account code or reference.