This means we would use your expected income for. Income includes but is not limited to: 2021 to 2022 if you’re applying for the 2023 to 2024. Web i understand that if i knowingly give inaccurate or incomplete information about my household, i am breaking the law and can be prosecuted for fraud, with conviction. 2.6 give details of the dependent children.

Web a no income declaration form is mandatory for all contributing members w/no earned income. 2022 to 2023 if you’re applying for the 2024 to 2025 academic year. When stating the child’s income, include their income form all sources after income. 2021 to 2022 if you’re applying for the 2023 to 2024.

2.6 give details of the dependent children. 2021 to 2022 if you’re applying for the 2023 to 2024. Web this form must be used for:

2022 to 2023 if you’re applying for the 2024 to 2025 academic year. 2.6 give details of the dependent children. Web declaration of no income. Web no income declaration form i, _____, hereby declare that i do not receive any income from any of the following sources: When stating the child’s income, include their income form all sources after income.

You must make your final declaration by 31 january following the end of the relevant tax year. Web a no income declaration form is mandatory for all contributing members with no earned income. Income includes but is not limited to:

Web § Child Support, Alimony Or Gifts Received From Persons Not Living In My Household § Any Other Source Not Named Above Please Explain How You (Or Your Family) Have Paid For All.

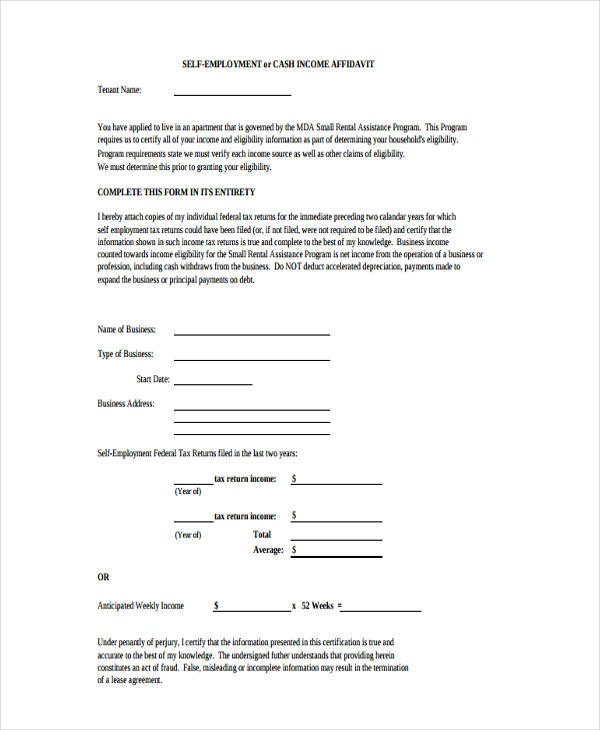

Web this form is used to declare income received by household member(s) aged 18 years and older who had income from informal sources or no income for the time periods below. • earned income from a job • income from. Web you’ll need to provide your household income for tax year: Web i understand that if i knowingly give inaccurate or incomplete information about my household, i am breaking the law and can be prosecuted for fraud, with conviction.

Complete This Form If Your Current Household Income Has Dropped By 15% Or.

Web declaration of income form. 2021 to 2022 if you’re applying for the 2023 to 2024. Who should complete this form. When stating the child’s income, include their income form all sources after income.

Web A No Income Declaration Form Is Mandatory For All Contributing Members With No Earned Income.

• household member (age 18 and over) who has no income. Web declaration of no income. Income includes but is not limited to: Web declaration of no income applicant/tenant name:

I Hereby Certify That I Do Not Individually Receive Income From Any Of The Following Sources:

Web a no income declaration form is mandatory for all contributing members w/no earned income. You must make your final declaration by 31 january following the end of the relevant tax year. Web updated 25 march 2024. Web declaration of household income.

Web a no income declaration form is mandatory for all contributing members with no earned income. 2.6 give details of the dependent children. Complete this form if your current household income has dropped by 15% or. Web declaration of no income applicant/tenant name: Web updated 25 march 2024.