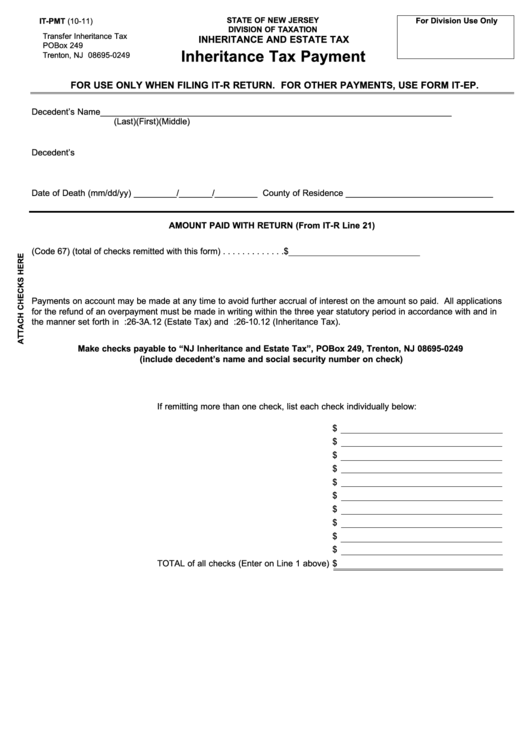

State of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. If a trust agreement either exists or is created by the will, the division may require a full return should the terms of the trust indicate a possible inheritance tax. A waiver from the new jersey division of taxation releasing property where located from the inheritance taxes. Real property which is held by a husband or wife as tenants by the entirety can be transferred without a tax waiver in the estate of the first spouse to pass on. Web executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement.

Web using the appraised date of death value and the date of death values of your uncle’s other assets, you — or more likely, a tax preparer such as an accountant — will be able to prepare and file the. Web inheritance and estate tax forms. Download your updated document, export it to the cloud, print it from the editor, or share it with others using a shareable link or as an email attachment. Web executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement.

• stock in new jersey corporations; Funds held in new jersey financial institutions; Web this form may be used when:

Form 60047 Application For Release Of Inheritance/estate Tax Liens

There is, however, an alternative designed to allow for the state to issue a waiver in cases when no tax is due and the alternative does not require that a full tax return be filed. Web executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. Web there is no tax on amounts inherited by class a or e beneficiaries. A waiver would not then be issued from this form. Real property held as tenancy by the entirety by a husband and wife or civil union partners as tenancy can be transferred without a tax waiver in.

Web executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. Web updated on december 21, 2023. The size (in dollar value) of the whole estate.

Web One Way To Obtain The Tax Waiver Is To File A Completed Inheritance Tax Return.

This form may be used only if all beneficiaries are class a, there is no new jersey inheritance or estate tax, and there is no requirement to file a tax return. • new jersey bank accounts; Web using the appraised date of death value and the date of death values of your uncle’s other assets, you — or more likely, a tax preparer such as an accountant — will be able to prepare and file the. The size (in dollar value) of the whole estate.

Web Inheritance And Estate Tax Forms.

Web to obtain a waiver or determine whether any tax is due, you must file a return or form. A waiver from the new jersey division of taxation releasing property where located from the inheritance taxes. Web updated on december 21, 2023. For release of nj bank accounts, stock, brokerage accounts and investment bonds.

Brokerage Accounts Doing Business In New Jersey;

• stock in new jersey corporations; Use this form to request release of: Web this form may be used when: There is, however, an alternative designed to allow for the state to issue a waiver in cases when no tax is due and the alternative does not require that a full tax return be filed.

There Is A $25,000 Exemption For Amounts Inherited By Class C Beneficiaries.

Web when there is any new jersey inheritance tax or estate tax due. If a trust agreement either exists or is created by the will, the division may require a full return should the terms of the trust indicate a possible inheritance tax. We break down new jersey inheritance laws, including what happens if you die without a valid will and where you may stand if you’re not part of the decedent’s immediate family. New jersey has had an inheritance tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary.

State of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. Or • all beneficiaries are class e, or class e and class a. Web cases, a full return must be filed with the inheritance tax branch, even if the assets all appear to be passing to class a beneficiaries. Use this form to request release of: The size (in dollar value) of the whole estate.