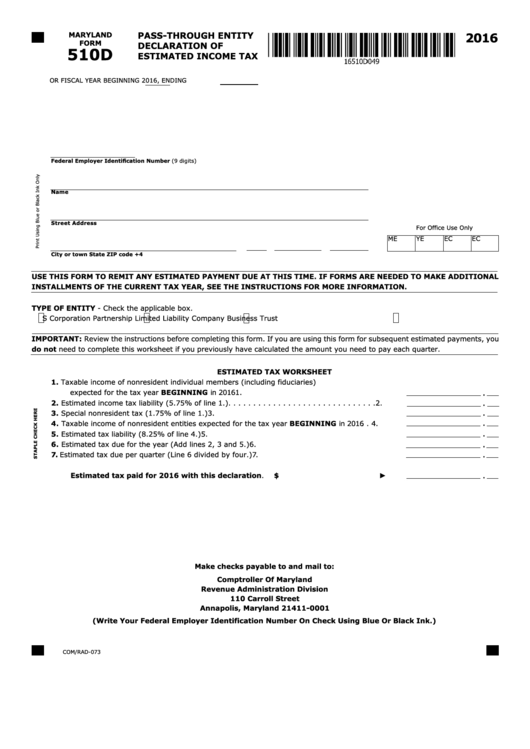

Web we last updated maryland form 510 in january 2024 from the maryland comptroller of maryland. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web this affirms the instructions for 2023 maryland form 510/511d: Maryland form 510 is a form commonly used among maryland residents to pay both their state and local taxes. Form 510c schedule a is attached.

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form may be used if the pte is paying. Form 510/511d is used by a. Web must attach with form 510c:

Form 510/511d is used by a. Form 510c accurately reflects the maryland taxable income and tax liability of each individual member shown on the return, and 2. (1) form 510c schedule a, (2) the pte’s form 510 schedule b, part i for individual members;

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form is for income earned in tax year 2023, with tax returns due in april. And (3) the members’ maryland schedule k. (1) form 510c schedule a, (2) the pte’s form 510 schedule b, part i for individual members; This form may be used if the pte is paying.

Form 510c schedule a is attached. Web maryland form 510 or fiscal year beginning 2023, ending print using blue or black ink only. Maryland form 510 is a form commonly used among maryland residents to pay both their state and local taxes.

This Form Is For Income Earned In Tax Year 2023, With Tax Returns Due In April.

This form may be used if the pte is paying. Web we last updated maryland form 510 in january 2024 from the maryland comptroller of maryland. Form 510/511d is used by a. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

You Can Download Or Print Current.

Form 510c schedule a is attached. 2023 $ federal employer identification. Web must attach with form 510c: Web maryland form 510 or fiscal year beginning 2023, ending print using blue or black ink only.

This Form May Be Used If The Pte Is Paying.

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Form 510c accurately reflects the maryland taxable income and tax liability of each individual member shown on the return, and 2. And (3) the members’ maryland schedule k. (1) form 510c schedule a, (2) the pte’s form 510 schedule b, part i for individual members;

Maryland Form 510 Is A Form Commonly Used Among Maryland Residents To Pay Both Their State And Local Taxes.

Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web this affirms the instructions for 2023 maryland form 510/511d:

Form 510c accurately reflects the maryland taxable income and tax liability of each individual member shown on the return, and 2. Web we last updated maryland form 510 in january 2024 from the maryland comptroller of maryland. 2023 $ federal employer identification. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Maryland form 510 is a form commonly used among maryland residents to pay both their state and local taxes.