Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. The options institute at cboe ®. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web updated october 31, 2021. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later.

Furthermore, any substantial movement in. It involves buying and selling contracts at the same strike price but expiring on different dates. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web updated october 31, 2021.

Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying stock. Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’.

This strategy anticipates a moderate drop in. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web use the optionscout profit calculator to visualize your trading idea for the long put calendar spread strategy.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Web put calendar spreads primarily bear the risks of unexpected high volatility and significant movement of the underlying asset’s price away from the strike price. This strategy can be done with either calls or puts.

It Is Sometimes Referred To As A Horiztonal Spread, Whereas A Bull Put Spread Or Bear Call Spread Would Be Referred To As A Vertical Spread.

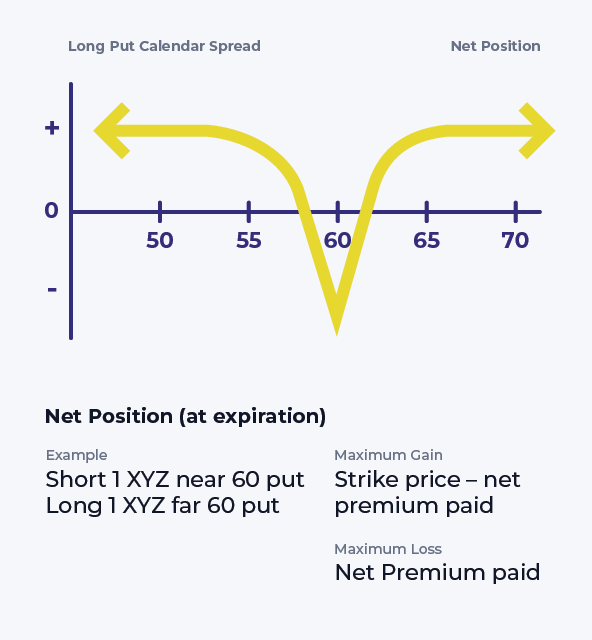

Maximum risk is limited to the price paid for the spread (net debit). Option trading strategies offer traders and investors the opportunity to profit in ways not available to those. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying stock. Web a calendar spread is an options strategy that involves multiple legs.

This Strategy Anticipates A Moderate Drop In.

Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Options have many strategies that allow you to profit in any market, and calendar spreads are just such a strategy.

It Is A Strategy Used By Investors Who Think The Security Price Will Be Close To The Strike Price At Expiration.

Furthermore, any substantial movement in. Maximum profit is realized if the underlying is equal to the strike at expiration. The options institute at cboe ®. Web use the optionscout profit calculator to visualize your trading idea for the long put calendar spread strategy.

Calendar Spreads Offer Traders The Flexibility To Profit In Neutral, Bullish, And Bearish Markets.

Web a calendar spread is a strategy used in options and futures trading: This strategy can be done with either calls or puts. This spread is considered an advanced options strategy. Web long put calendar spread:

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Web use the optionscout profit calculator to visualize your trading idea for the long put calendar spread strategy. Options have many strategies that allow you to profit in any market, and calendar spreads are just such a strategy. Depending on where the stock is relative to the strike price when implemented the forecast can either be neutral, bullish or bearish. Option trading strategies offer traders and investors the opportunity to profit in ways not available to those.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)