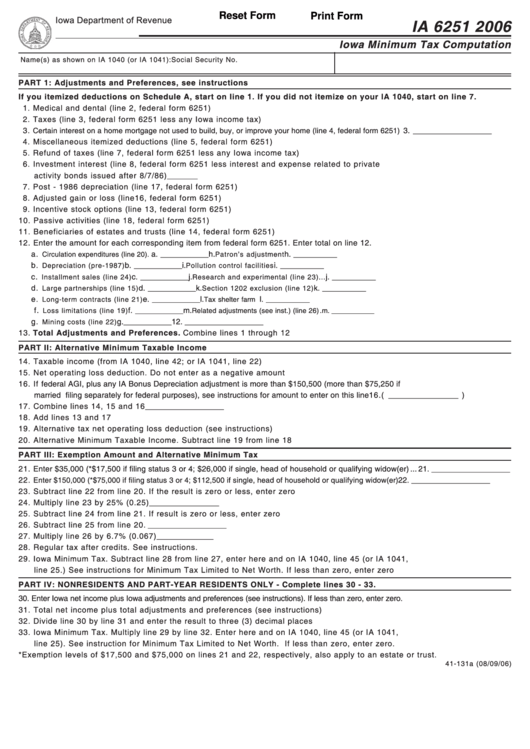

Web the simplest way to see why you are paying the amt, or how close you came to paying it, is to look at your form 6251 from last year. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, or other nonconformity. What tax preference items are included in calculating amt. If you itemized deductions on schedule a (ia 1040), start on line 1. Web form ia 6251 to see if they owe iowa alternative minimum tax (amt).

Enter iowa net income plus iowa adjustments and preferences. We last updated iowa form ia 6251 in february 2023 from the iowa department of revenue. Web federal form 6251 to adjust for the iowa amount. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, or other nonconformity.

Section references are to the internal revenue. All individuals, estates and trusts that had one or more of the adjustments or preferences in part i must complete form ia. Web the simplest way to see why you are paying the amt, or how close you came to paying it, is to look at your form 6251 from last year.

The program is recording incorrectly on the iowa 6251 when i file separately on the combined return. Per irs instructions for form 6251: Taxpayers may have an iowa amt liability even if they do not owefederal amt. If you itemized deductions on schedule a (ia 1040), start on line 1. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying.

The program is recording incorrectly on the iowa 6251 when i file separately on the combined return. Web form ia 6251 to see if they owe iowa alternative minimum tax (amt). How tax planning can help you avoid amt and lower your total tax bill.

Use Form 6251 To Figure The Amount, If Any, Of Your Alternative Minimum Tax (Amt).

Web file now with turbotax. Web instructions for form 6251. The exemption amount on form 6251, line 5, has increased to $81,300 ($126,500 if married filing jointly or qualifying. We last updated iowa form ia 6251 in february 2023 from the iowa department of revenue.

The Amt Is A Separate Tax That Is Imposed In Addition To Your.

Section references are to the internal revenue. Taxpayers may have an iowa amt liability even if they do not owefederal amt. Name(s) as shown on ia 1040 or ia 1041. Web form ia 6251 to see if they owe iowa alternative minimum tax (amt).

All Individuals, Estates And Trusts That Had One Or More Of The Adjustments Or Preferences In Part I Must Complete Form Ia.

Iowa department of revenue www.iowa.gov/tax. The program is recording the. This form is for income earned in tax year 2023, with tax. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, or other nonconformity.

Web The Simplest Way To See Why You Are Paying The Amt, Or How Close You Came To Paying It, Is To Look At Your Form 6251 From Last Year.

Web turbotax error on iowa 6251. Who must file ia 6251. Per irs instructions for form 6251: How tax planning can help you avoid amt and lower your total tax bill.

Who must file ia 6251. Web more about the iowa form ia 6251 individual income tax. Web the simplest way to see why you are paying the amt, or how close you came to paying it, is to look at your form 6251 from last year. The amt is a separate tax that is imposed in addition to your. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt).