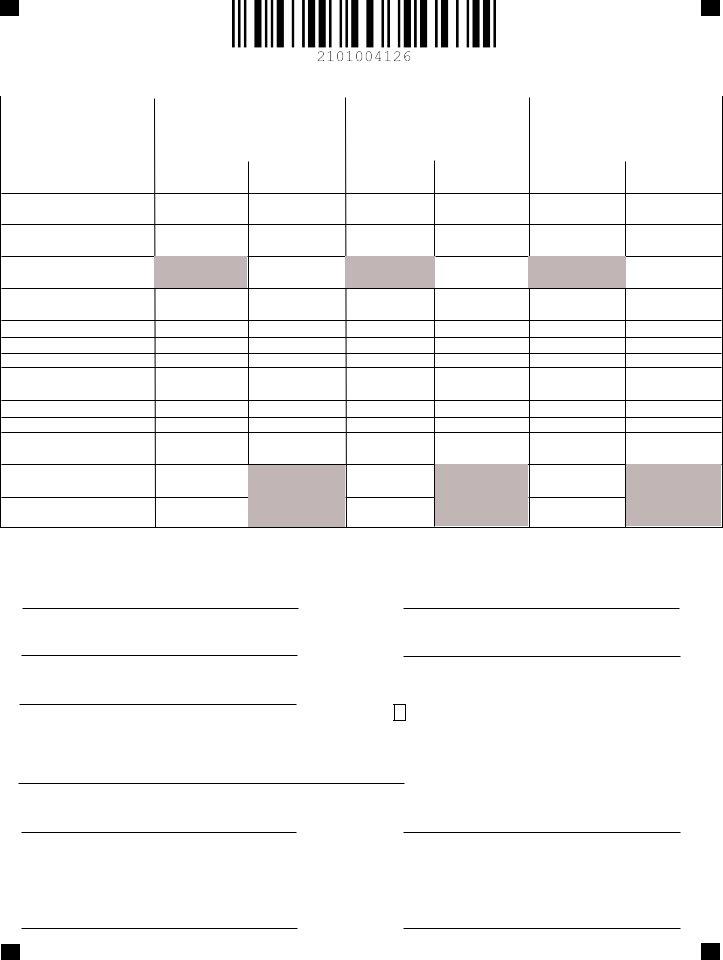

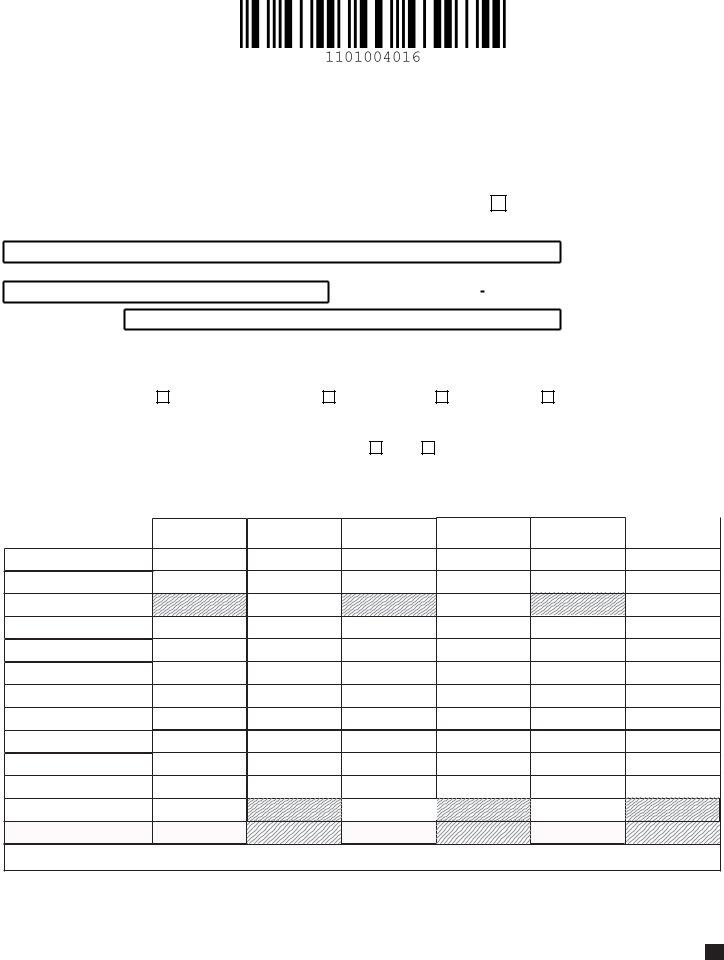

Georgia department of revenue processing center po box. (approved web version) page 1. Georgia department of revenue processing center po. Nol was carried foward from irs form 1040. Web claimed nol on georgia form 500 for tax year 2019.

Nol was carried foward from irs form 1040. Georgia department of revenue processing center po box. Georgia department of revenue processing center. Net operating loss adjustment for other than corporations (rev.

03/05/18) for individuals and fiduciaries. We last updated the net operating loss. Net operating loss adjustment for other than corporations (rev.

08/30/23) individual income tax return. Georgia department of revenue processing center. Georgia department of revenue processing center po box. Web instead the part year and nonresident schedule above should be completed. There are no carrybacks in prior years on the federal tax.

We last updated the net operating loss. Web georgia form 500 (rev. Net operating loss adjustment for other than corporations (rev.

Web Instead The Part Year And Nonresident Schedule Above Should Be Completed.

08/30/23) individual income tax return. Georgia — net operating loss adjustment. (approved web version) page 1. There are no carrybacks in prior years on the federal tax.

We Last Updated The Net Operating Loss.

Net operating loss adjustment for other than corporations (rev. The other state(s) tax credit and low income credit are claimed directly on form 500. Net operating loss adjustment for individuals and fiduciaries (rev. Web claimed nol on georgia form 500 for tax year 2019.

Georgia Department Of Revenue Processing Center Po Box.

It appears you don't have a pdf plugin for this browser. For carryback purposes, the form must be filed no later than 3 years from. If the loss year is a part year or nonresident year for lines 3a, 3b, 6, and 11, compute. Net operating loss adjustment for individuals and fiduciaries.

Complete, Save And Print The Form Online Using Your Browser.

Web a net operating loss carryback adjustment may be filed on this form by an individual or fiduciary taxpayer that desires a refund of taxes afforded by carryback of a net operating. Georgia department of revenue processing center po. 09/12/19) your ssn or fein. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed.

09/12/19) your ssn or fein. Net operating loss adjustment for individuals and fiduciaries (rev. The other state(s) tax credit and low income credit are claimed directly on form 500. (approved web version) page 1. Net operating loss adjustment for other than corporations (rev.