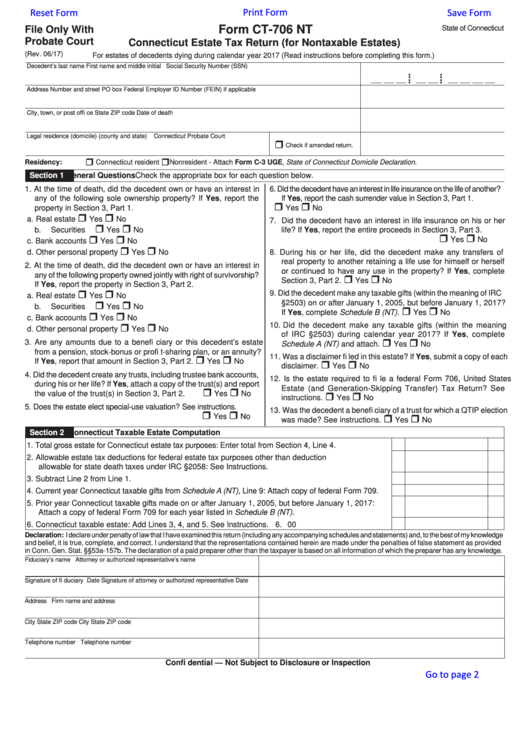

Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Web 8 rows revised date. Web form ct‐706 nt must be filed for: For decedents dying on or after january 1, 2011, the connecticut estate tax exemption amount is $2 million. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this.

Web where applicable, the code will link directly to information on the type of probate matter associated with the form. • each decedent who, at the time of death, was a connecticut resident; 2021 application for extension of time for filing. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this.

2021 application for extension of time for filing. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this. For each decedent who, at the time of death, was a nonresident of.

• each decedent who, at the time of death, was a connecticut resident; For decedents dying on or after january 1, 2011, the connecticut estate tax exemption amount is $2 million. 2021 connecticut estate tax return (for nontaxable estates) instructions. 2021 application for extension of time for filing. Web where applicable, the code will link directly to information on the type of probate matter associated with the form.

Web form ct‐706 nt must be filed for: Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this. • each decedent who, at the time of death, was a connecticut resident;

• For Each Decedent Who, At The Time Of Death, Was A Nonresident

2021 connecticut estate tax return (for nontaxable estates) instructions. • each decedent who, at the time of death, was a connecticut resident; Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2022 (read instructions before completing this. 2021 application for extension of time for filing.

• Each Decedent Who, At The Time Of Death, Was A Connecticut Resident;

For each decedent who, at the time of death, was a nonresident of. • for each decedent who, at the time of death, was a nonresident. For decedents dying on or after january 1, 2011, the connecticut estate tax exemption amount is $2 million. Each decedent who, at the time of death, was a connecticut resident;

Web Where Applicable, The Code Will Link Directly To Information On The Type Of Probate Matter Associated With The Form.

Therefore, connecticut estate tax is due from. Web 8 rows revised date. Web form ct‐706 nt must be filed for:

Each decedent who, at the time of death, was a connecticut resident; Web where applicable, the code will link directly to information on the type of probate matter associated with the form. 2021 application for extension of time for filing. • for each decedent who, at the time of death, was a nonresident. • for each decedent who, at the time of death, was a nonresident