Calculates capital gains and losses accurately: You should only use the form to report an environmental. Add form 8453 to the return. Web make sure it's ok to bypass form 8949. Form 8949 provides the cost.

Web “the sale or exchange of a capital asset not reported on another form or schedule” — i.e., if you’ve offloaded a capital asset, you’ll report it here. Web use form 8949 to report sales and exchanges of capital assets. Web form 8949 tells the irs all of the details about each stock trade you make during the year, not just the total gain or loss that you report on schedule d. Web exceptions to form 8949 reporting.

Form 8949 doesn't change how. Check box a, b, or. In most cases cryptocurrency or virtual.

Regarding reporting trades on form 1099 and schedule d, you must report each trade separately by either: Web schedule d, line 1a; Check box a, b, or. Web about form 8949, sales and other dispositions of capital assets. Including each trade on form 8949, which.

Solved • by intuit • 95 • updated july 20, 2023. You should only use the form to report an environmental. Attaching a summary statement to schedule d/form 8949 in proconnect tax and resolving diagnostic ref.

Web Reporting Environmental Incidents To Report An Environmental Incident That Is Happening Now, Call 0800 80 70 60.

Form 8949 doesn't change how. This article will help to report. You aren’t required to report these transactions on form 8949 (see instructions). In most cases cryptocurrency or virtual.

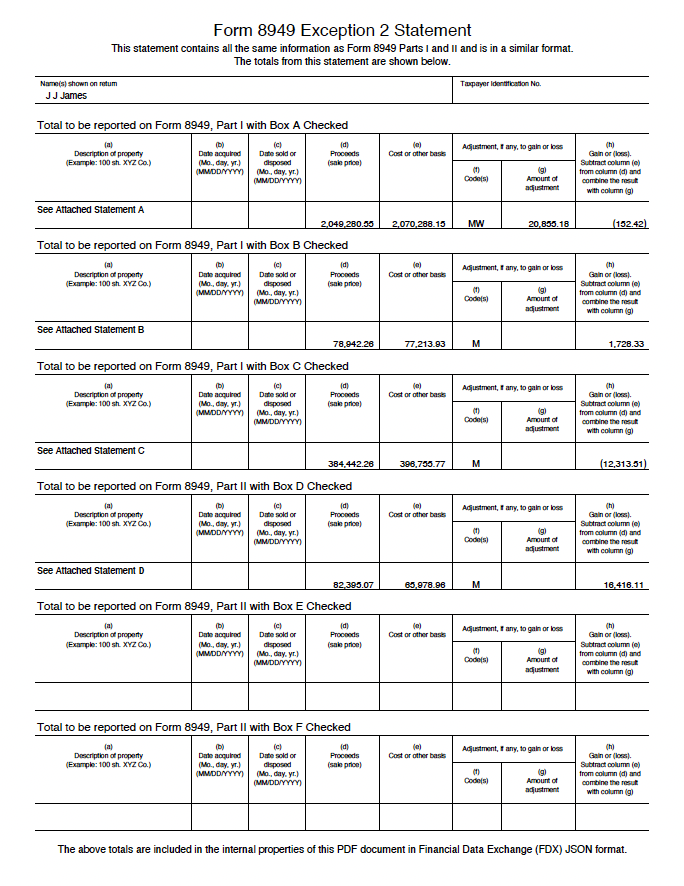

Web Per The Instructions For Form 8949, There Are Two Exceptions To Reporting All Transaction On Separate Rows Of Part I And Part Ii Of Form 8949 Which Are Available To.

Calculates capital gains and losses accurately: Web schedule d, line 1a; Web use form 8949 to report sales and exchanges of capital assets. Web make sure it's ok to bypass form 8949.

Rename The Scanned Statement To.

If both exceptions apply, you can use both. Web reporting form 8949, exception 2 each transaction on a separate line in lacerte. Covered activities (showing basis on the 1099b) only need to be reported in total and not broken. You should only use the form to report an environmental.

Solved•By Intuit•211•Updated 1 Month Ago.

Regarding reporting trades on form 1099 and schedule d, you must report each trade separately by either: Web entering stock transactions for form 8949 or schedule d in proconnect tax. Web exceptions to form 8949 reporting. Web there are 2 exceptions to filing form 8949.

If both exceptions apply, you can use both. Including each trade on form 8949, which. You aren’t required to report these transactions on form 8949 (see instructions). Web entering stock transactions for form 8949 or schedule d in proconnect tax. Web schedule d, line 1a;