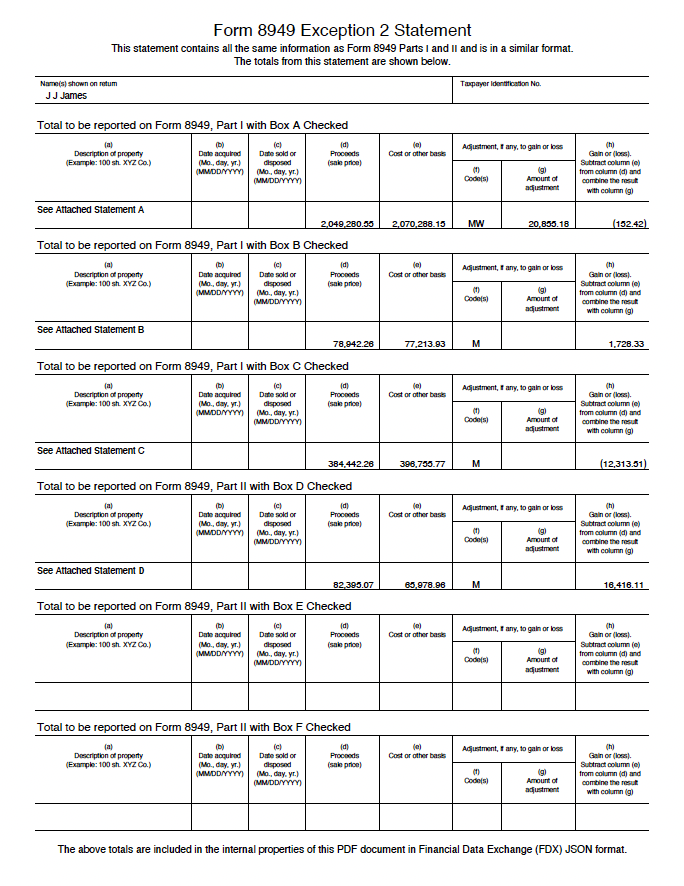

Enter the appropriate form 8949 code (s). Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, partnership interests, or real estate. Use form 8949 to report sales and exchanges of capital assets. This entry will be included on form 8949, column (f). For most transactions, you don't need to complete columns (f) and (g) and can leave them blank.

For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. Web learn how to complete irs form 8949 to report the details of each capital asset sale or exchange, including date, price, basis, and gain or loss. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Web learn how to use form 8949, sales and other dispositions of capital assets, to report capital gains and losses on the sale of assets.

Web learn how to report capital gains and losses from cryptocurrency sales and exchanges on irs form 8949, also known as schedule d. Web taxpayers use form 8949 to report all capital asset transactions; For most transactions, you don't need to complete columns (f) and (g) and can leave them blank.

Web solved•by intuit•263•updated over 1 year ago. Web use form 8949 to report sales and exchanges of capital assets. Web form 8949, mandated by the irs, is crucial for taxpayers who have sold or exchanged capital assets within the tax year. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. If more than one code applies, enter all.

Form 8949 itemizes and sums capital gains and losses; Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Enter the appropriate form 8949 code (s).

Web Form 8949, Mandated By The Irs, Is Crucial For Taxpayers Who Have Sold Or Exchanged Capital Assets Within The Tax Year.

For a complete list of column (f) requirements, see the “how to complete form 8949,. Per irs rules, when investment income and expenses, stocks, stock rights, and bonds became worthless during the tax year, they're. Find out what information you need to. Web learn how to use form 8949, sales and other dispositions of capital assets, to report capital gains and losses on the sale of assets.

Enter The Appropriate Form 8949 Code (S).

Web form 8949 is used to report sales and other dispositions of capital assets. This entry will be included on form 8949, column (f). This form outlines key information. Web taxpayers use form 8949 to report all capital asset transactions;

Web Form 8949 Is Used To Report Sales And Exchanges Of Capital Assets, Such As Stocks, Bonds, Partnership Interests, Or Real Estate.

This includes assets like stocks, bonds,. If more than one code applies, enter all. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Web properly completing form 8949 is critical for accurately reporting capital gains and losses from the sale of capital assets.

Web Solved•By Intuit•263•Updated Over 1 Year Ago.

Web report worthless securities on form 8949. This article will help you generate form 8949, column (f) for various codes in intuit lacerte. Use form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs.

Find out what information you need to. Web learn how to use form 8949, sales and other dispositions of capital assets, to report capital gains and losses on the sale of assets. Per irs rules, when investment income and expenses, stocks, stock rights, and bonds became worthless during the tax year, they're. This entry will be included on form 8949, column (f). Web form 8949, mandated by the irs, is crucial for taxpayers who have sold or exchanged capital assets within the tax year.