Web mail the form to the irs using the information at the bottom of this page. Web write your address in the u.s. Individuals who were classified as residents for tax purposes (ra) in 2023 do not complete the 8843. If you are a nonresident tax filer with u.s. This is true even if.

Web status (b, vw, h, etc.) do not complete the 8843. Go to www.irs.gov/form8843 for the latest information. Web ***don't forget to sign the form on page 2!*** v. And the date on which you entered.

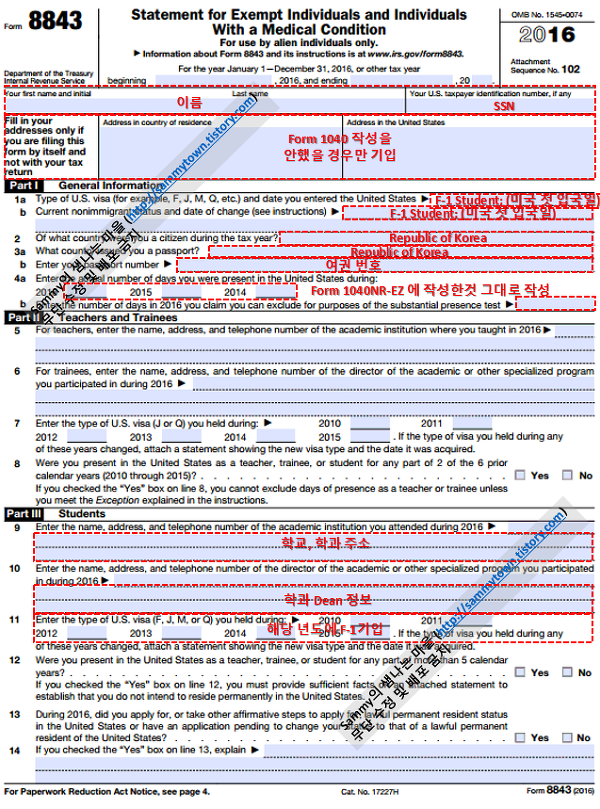

Statement for exempt individuals and individuals with a medical condition. Go to www.irs.gov/form8843 for the latest information. Web write your address in the u.s.

If you have been in the. Individuals who were classified as residents for tax purposes (ra) in 2023 do not complete the 8843. It is a simplified version of the irs instructions found on pp. Web mail the form to the irs using the information at the bottom of this page. Web about form 8843, statement for exempt individuals and individuals with a medical condition about form 8843, statement for exempt individuals and individuals.

Web nonresident tax filers. 29k views 6 years ago. For use by alien individuals only.

Web Form 8843, Statement For Exempt Individuals And Individuals With A Medical Condition.

It is a simplified version of the irs instructions found on pp. Web about form 8843, statement for exempt individuals and individuals with a medical condition about form 8843, statement for exempt individuals and individuals. Fill in your address (only if you are not filing a tax return). Web statement for exempt individuals and individuals with a medical condition.

This Is True Even If.

Web ***don't forget to sign the form on page 2!*** v. You can also refer to the following: Individuals who were classified as residents for tax purposes (ra) in 2023 do not complete the 8843. Web no income tax filing | berkeley international office.

Department Of The Treasury Internal Revenue Service.

We recommend that you choose tracking and receipt confirmation when you mail as the receipt. Web this guide has been created to assist you in completing the form 8843. Web if you are required to file a federal income tax return, your form 8843 is filed along with your tax return and has the same due date as your tax return (generally april 15). Source income and are using sprintax to file your tax return, your form 8843 will be included in.

Make A Photocopy Of Form 8843 For Your Permanent Records And Mail The.

Web status (b, vw, h, etc.) do not complete the 8843. If you are a nonresident tax filer with u.s. Web fill in the number of days you were present in the u.s. Web otherwise leave it blank.

Web nonresident tax filers. If you are a nonresident tax filer with u.s. Fill in your address (only if you are not filing a tax return). You can also refer to the following: For use by alien individuals only.