The name and address of your bank. Web the direct debit guarantee. Web a direct debit mandate is an instruction from your customer to their bank to authorise you to take payments. Web direct debit has strict rules, which say the organisation you are paying is responsible for checking all the information contained on your direct debit instruction, and that they have sufficient identification. Direct debits are trusted by millions of us across the uk each day.

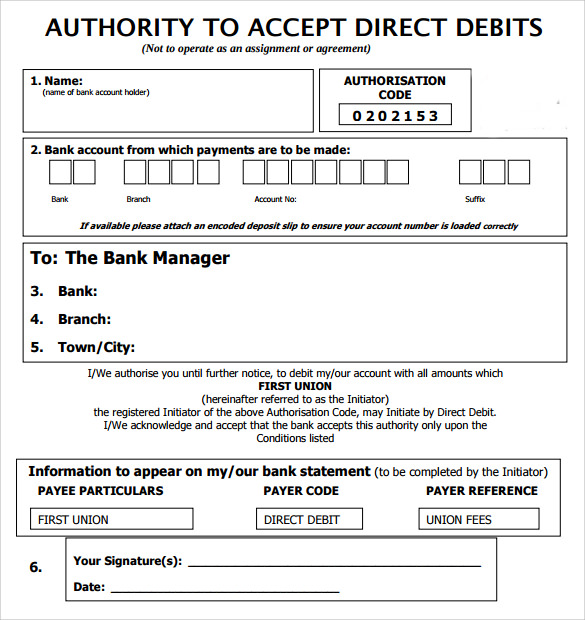

Web direct debit form is a document that is used to provide authorization coming from the account owner that allows regular and future payments to the biller. This form is usually used in a bank wherein the account owner requires to fill up all the important information that authorizes a biller to charge him or her on a regular basis and the bank. Web direct debit takes the pain out of regular payments. Your name and address, your bank's name and address, your account number and sort code.

Direct debits are often used for mortgage, phone, energy or gas bills. It must be included on all direct debit instructions (ddis) and should also be featured in all literature. The name and address of your bank.

If your bank or building society thinks there’s something wrong, they can request a copy of the direct debit instruction from the. The main advantage of direct debits is the flexibility, as the payments can vary in amount or frequency. Web when you sign a direct debit form or mandate, you give that company permission to take a certain amount each month. Web direct debit form is a document that is used to provide authorization coming from the account owner that allows regular and future payments to the biller. Your account number and sort code.

Web use the making tax digital vatc9 form to tell your bank or building society to set up a direct debit to pay your vat. This guarantee is offered by all banks and building societies that accept instructions to pay direct debits • if there are any changes to the amount, date or frequency of your direct debit, information commissioner will notify you 10 working days in advance of your account being debited or as otherwise agreed. Did you know that 4.8 billion payments were made this way in 2022.

Web Use The Making Tax Digital Vatc9 Form To Tell Your Bank Or Building Society To Set Up A Direct Debit To Pay Your Vat.

The main advantage of direct debits is the flexibility, as the payments can vary in amount or frequency. Your name and address, your bank's name and address, your account number and sort code. Web the direct debit guarantee. So to maximise your use of the service, use the distinctive direct debit logo across as wide a range of media as possible.

Web Direct Debit Takes The Pain Out Of Regular Payments.

The name and address of your bank. Instruct your bank or building society to pay your vat by direct. Once set up, your payments are made for you automatically, meaning you don’t need to worry about missing an important bill or racking up late payment fees. If you set up the direct debit over the phone or online then you will be sent written confirmation of the direct debit instruction.

Direct Debits Are Trusted By Millions Of Us Across The Uk Each Day.

Direct debit is already recognised by many organisations and consumers as the easiest way to pay. Web how to set up a direct debit. This form is usually used in a bank wherein the account owner requires to fill up all the important information that authorizes a biller to charge him or her on a regular basis and the bank. This guarantee is offered by all banks and building societies that accept instructions to pay direct debits • if there are any changes to the amount, date or frequency of your direct debit, information commissioner will notify you 10 working days in advance of your account being debited or as otherwise agreed.

This Could Be Online, Or You May Need To Request A Physical Form From The Company.

Web when you sign a direct debit form or mandate, you give that company permission to take a certain amount each month. Web a direct debit mandate is an instruction from your customer to their bank to authorise you to take payments. Did you know that 4.8 billion payments were made this way in 2022. Web direct debit form is a document that is used to provide authorization coming from the account owner that allows regular and future payments to the biller.

Instruct your bank or building society to pay your vat by direct. This could be online, or you may need to request a physical form from the company. Once set up, your payments are made for you automatically, meaning you don’t need to worry about missing an important bill or racking up late payment fees. This guarantee is offered by all banks and building societies that accept instructions to pay direct debits • if there are any changes to the amount, date or frequency of your direct debit, information commissioner will notify you 10 working days in advance of your account being debited or as otherwise agreed. Direct debits are trusted by millions of us across the uk each day.