Reinsurepro offers a private flood option as well as nfip. This form of coverage is, like its name, the one with the least “extra stuff” included. Web what’s the difference between basic, broad, and special form insurance coverages. Web if you’ve shopped by features insurance before, thou might have noticed this some policies list covering losses since basic, while others specify broad or special. It's important to consider more than price.

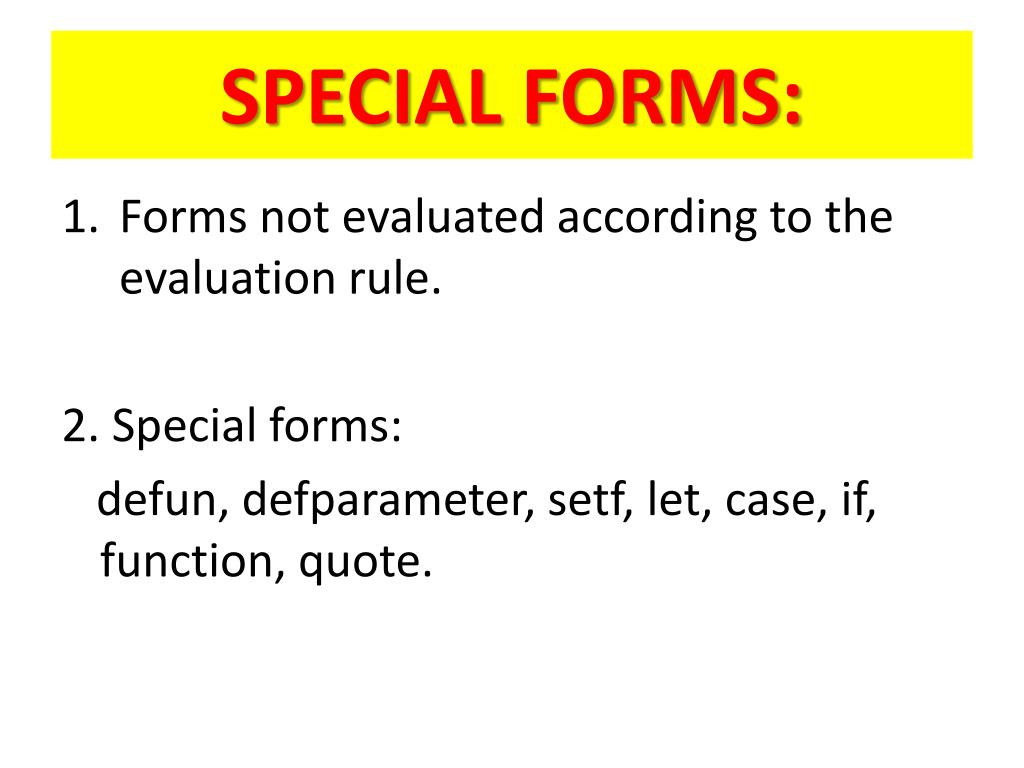

Web “basic”, “broad”, and “special” coverage types are very different from one another. Causes of loss forms establish and. Web basic causes of loss form is one of the three insurance services office, inc. Anything that is unlisted is covered, anything listed in the exclusions section is excluded.

The special form insurance policy is the ideal form for property. Special form coverage covers all risks. Web so essentially, a special form insurance policy is read opposite of a basic or broad form insurance policy.

Basic vs Special Form Coverage Insurance Resources

PPT What is an adjective ? PowerPoint Presentation ID5268804

The special form is the most. Web the basic and broad causes of loss forms are named perils forms; Web whenever you’ve shopped for property insurance before, you may possess noticed this some policies list covered losses as basic, while others specify broad or special. Web unlike basic and broad form coverage, special form policies cover any type of sudden and accidental loss unless it is specifically excluded, such as earthquakes, backup of. Causes of loss forms establish and.

Causes of loss forms establish and. Web the basic and broad causes of loss forms are named perils forms; Web whenever you’ve shopped for property insurance before, you may possess noticed this some policies list covered losses as basic, while others specify broad or special.

(Iso), Commercial Property Insurance Causes Of Loss Forms.

There can be back to one 30% difference between this principle. When you're shopping for the best value for your personal or commercial insurance requirements,. It makes sense that basic has the least amount of coverages and special has the most, so the more coverage you. Web “basic”, “broad”, and “special” coverage types are very different from one another.

The Special Form Is The Most.

Web difference between basic, broad, and special form insurance coverages. This is why it is so important for you to consider both the risks and price associated with each. Web learn the difference between basic and special forms. Web at the end of the day, however, the special form gives you much more comprehensive insurance protection than the basic or broad forms.

The Special Form Insurance Policy Is The Ideal Form For Property.

*while other insurers often exclude theft, reinsurepro’s special form does. They provide coverage for loss from only the particular causes that are listed in the policy as covered. Web while both basic and broad form coverage encompass perils specifically listed in their policies, special form does almost the opposite. Web a special causes of loss form is one of the three insurance services office, inc.

Web What’s The Difference Between Basic, Broad, And Special Form Insurance Coverages.

This form of coverage is, like its name, the one with the least “extra stuff” included. Web whenever you’ve shopped for property insurance before, you may possess noticed this some policies list covered losses as basic, while others specify broad or special. You’ll have coverage for 11 perils and those 11 perils only. Causes of loss forms establish and.

Web basic causes of loss form is one of the three insurance services office, inc. Web if dialing insurance coverage, consider more more which value of the policy opportunities. Web so essentially, a special form insurance policy is read opposite of a basic or broad form insurance policy. There can be back to one 30% difference between this principle. Web special form offers the highest and most comprehensive level of coverage of the three or the “platinum level.” it encompasses the perils under basic, broad, and goes beyond.