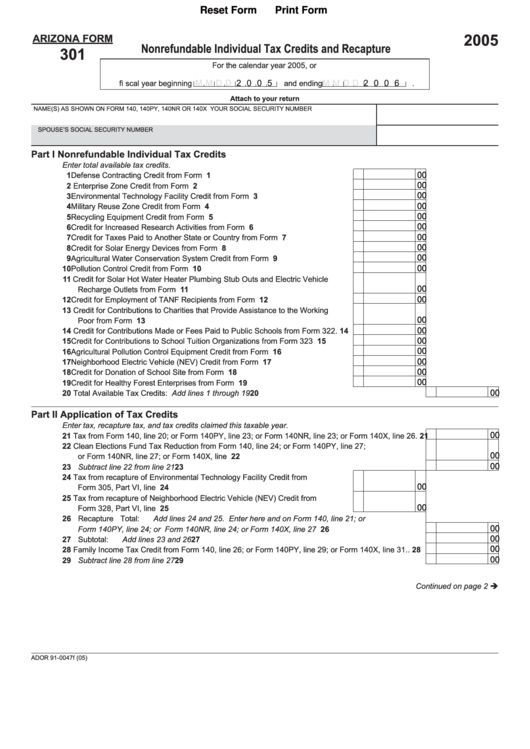

Web you can claim tax credits by completing form 321 and form 301 and attaching them to your arizona tax return. • summarize your total available nonrefundable tax credits. Web arizona form 301 nonrefundable individual tax credits and recapture 2021 part 1 nonrefundable individual tax credits available: Only complete this section if the both of the following are true: Or form 140nr, line 56;

• summarize your total available nonrefundable tax credits. Or form 140x, line 35. Form 335 is used in claiming the corporate tax credit. Web you must complete and arizona include form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required.

32 tax from form 140, line 46; Web arizona form 301 nonrefundable individual tax credits and recapture 2019. Ador 10127 (15) a orm 301 2015 page 2 of 2.

Download Instructions for Arizona Form 301SBI, ADOR11405 Nonrefundable

It appears you don't have a pdf plugin for this browser. 2022 nonrefundable individual tax credits and recapture arizona form 301. You must complete and include arizona form 301 with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. Enter tax, recapture tax, and tax credits used this taxable year. Web arizona form 301 nonrefundable individual tax credits and recapture 2015.

Part 2 application of tax credits and recapture: 32 tax from form 140, line 46; Part 2 application of tax credits and recapture:

Ador 10127 (19) A Orm 301 2019 Page 2 Of 2.

Summarize your total available nonrefundable tax credits. Web arizona form 301 nonrefundable individual tax credits and recapture 2015. You must complete and include arizona form 301 with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. Form 335 is used in claiming the corporate tax credit.

Enter Tax, Recapture Tax, And Tax Credits Used This Taxable Year.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. Web file now with turbotax. Web arizona form nonrefundable individual tax credits and recapture for 301 forms 140, 140py, 140nr and 140x 2023 part 1 nonrefundable individual tax credits available: Or form 140x, line 37.

Enter Total Available Tax Credits.

Ador 10127 (15) a orm 301 2015 page 2 of 2. Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. 42 00 43 subtract line 42 from line 41. You will find the credits in the final part of the arizona interview.

Or Form 140X, Line 30.

Or form 140py, line 56; 38 00 39 subtract line 38 from line 37. Or form 140x, line 38. Web arizona form 301 nonrefundable individual tax credits and recapture 2017.

We last updated arizona form 301 in january 2024 from the arizona department of revenue. Enter tax, recapture tax, and tax credits used this taxable year. Enter tax, recapture tax, and tax credits used this taxable year. Tax year 2023 credit forms. Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000 per residence.