You can now transfer your vehicle online! Bill of sale with purchase price. Web plan your journey across the tfl network. Web you must produce a valid certificate of motor insurance that permits the release of a vehicle impounded by a government authority before your vehicle will be released, even if you don’t intend to drive it on a public road. The transfer of a motor vehicle from the decedent spouse’s estate to the surviving spouse (the death of a spouse terminates the community estate).

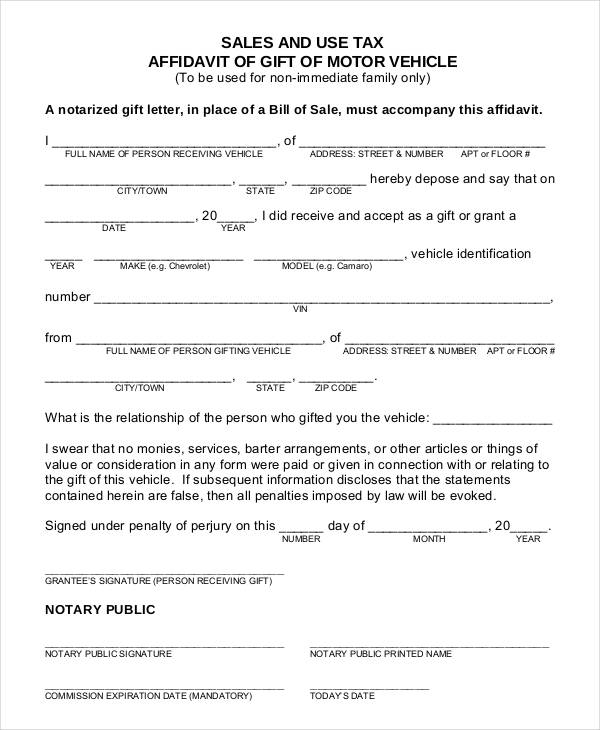

The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Release of lien if there is an outstanding loan. Web there are four ways to gift your property: This transfer is considered a gift, where the vehicle’s ownership is transferred voluntarily and without payment.

2 sale and purchase at under the market value. A gift is the transfer of a motor vehicle between eligible parties for no consideration. Web tax code §152.101 provides a penalty to a person who signs a false statement.

Without registration or credit card. If inherited, either the recipient or the person authorized to act on behalf of the estate must file the form. Web plan your journey across the tfl network. Affidavit requires both the donor and recipient's signature to be notarized. Bill of sale with purchase price.

Sellers must first submit an online notice of disposal via their myvicroads account. Affidavit requires both the donor and recipient's signature to be notarized. A physical copy of the document

The Transfer Of A Motor Vehicle From The Decedent Spouse’s Estate To The Surviving Spouse (The Death Of A Spouse Terminates The Community Estate).

The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. This motor vehicle is being transferred without consideration, including no. Bill of sale with purchase price. Journey planner for bus, tube, london overground, dlr, elizabeth line, national rail, tram, river bus, ifs cloud cable car, coach

The Purpose Of This Affidavit Is To Document The Gift Of A Motor Vehicle To An Eligible Recipient As Required By Texas Tax Code Section 152.062, Required Statements.

An offense under this section is a felony of the third degree. Web plan your journey across the tfl network. The donor or recipient filing the affidavit must file in person and must provide a valid form of identification. 3 deed of gift, also known as a 'transfer by way of gift' 4 transfer of.

A Gift Is The Transfer Of A Motor Vehicle Between Eligible Parties For No Consideration.

This affidavit must be filed in person by either the recipient of the gift or the person from whom the gift is received. Web there are four ways to gift your property: Record the odometer reading on the title or odometer disclosure statement. Web you must produce a valid certificate of motor insurance that permits the release of a vehicle impounded by a government authority before your vehicle will be released, even if you don’t intend to drive it on a public road.

2 Sale And Purchase At Under The Market Value.

If inherited, either the recipient or the person authorized to act on behalf of the estate must file the form. Your information is securely protected, as we adhere to the newest security criteria. Sellers must first submit an online notice of disposal via their myvicroads account. To transfer a car title to a family member as a gift in texas:

Release of lien if there is an outstanding loan. Bill of sale with purchase price. Web plan your journey across the tfl network. Sellers must first submit an online notice of disposal via their myvicroads account. The purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements.