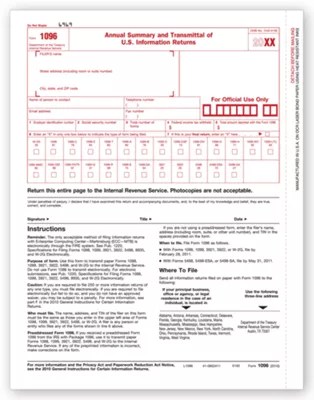

Enter the number of correctly completed forms, not the number of pages, being transmitted. Do not file draft forms and do not rely on draft forms, instructions, and pubs for filing. Information returns, is — as its official name implies — a summary document. How to use the 1096 form for contractor compensation. Web irs form 1096, officially known as the “annual summary and transmittal of u.s.

Irs form 1096, annual summary and transmittal of u.s. Web when is form 1096 due? Web if you submitted your federal tax return through direct file and it was rejected, you had until april 20, 2024 to correct and resubmit it electronically via direct file. Information returns, is — as its official name implies — a summary document.

Information returns, is used as a summary or “cover sheet” to various types of other forms only when submitting a paper filing to the irs. To create a new 1096 form. Information returns,” is a summary document used when filing certain irs information returns by mail.

Do not include blank or voided forms or the form 1096 in your total. Small business resource center small business tax prep. How to use the 1096 form for contractor compensation. Do not file draft forms and do not rely on draft forms, instructions, and pubs for filing. To create a new 1096 form.

To make corrections in a 1096 form. Instructions for form 1096 pdf. Web if you submitted your federal tax return through direct file and it was rejected, you had until april 20, 2024 to correct and resubmit it electronically via direct file.

However, As Of 2023, Employers That Need To Submit More Than 10 Information Returns (I.e., Form 1099S Or Others) Are Required To File Electronically.

This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. For the latest information about developments related to form 1096, such as legislation enacted after it was published, go to www.irs.gov/form1096. 2 what information is reported on form 1096? Web one such form is the 1096 form, also known as the annual summary and transmittal of u.s.

Page Last Reviewed Or Updated:

Information returns, is — as its official name implies — a summary document. Web january 19, 2024 09:53 am. 1 what is irs form 1096 and what is it used for? However, qbo no longer has the option to print the 1096 form in 2024 what happened?

Information About Form 1096, Annual Summary And Transmittal Of U.s.

Make sure to order scannable forms 1096 for filing with the irs. To print the 1096 form. The draft you are looking for begins on the next page. Web irs form 1096, officially known as the “annual summary and transmittal of u.s.

Irs Form 1096 Often Goes Unnoticed Amidst The Plethora Of Tax Documents, But It Plays A Critical Role In Tax Reporting.

This guide aims to demystify form 1096, making it accessible and understandable for anyone who needs to file it. Do you also use paper filing to file your tax forms? I have less than 10 1099s so i am printing my 1099s from qbo; How to complete irs form 1096.

However, qbo no longer has the option to print the 1096 form in 2024 what happened? Where to file form 1096. Web january 19, 2024 09:53 am. Where to get form 1096. Enter the total federal income tax withheld shown on the forms being transmitted with this form 1096.